Assets, Debts, and the Simple Math That Changes Everything

Personal finance can feel complicated. Budgets, investments, retirement plans, and debt payoff strategies… It’s easy to get overwhelmed!

But there’s one simple equation that cuts through a lot of the confusion.

Assets minus debts equals net worth.

Assets – Debts = Net Worth

That’s it. It doesn’t tell you everything. But it’s a formula that tells you something important about where you stand with money—namely, how much of it you have.

What Counts as an Asset?

In personal finance, so many vocabulary terms, even technical ones, have multiple different uses.

For our purposes, let’s consider an asset anything you own that has monetary value. Some assets grow in value. Others hold steady, and some lose value over time.

Common examples of assets include:

Money in checking or savings accounts

Retirement accounts (such as a 401(k), IRA, etc.)

Investments (like ETFs, bonds, mutual funds)

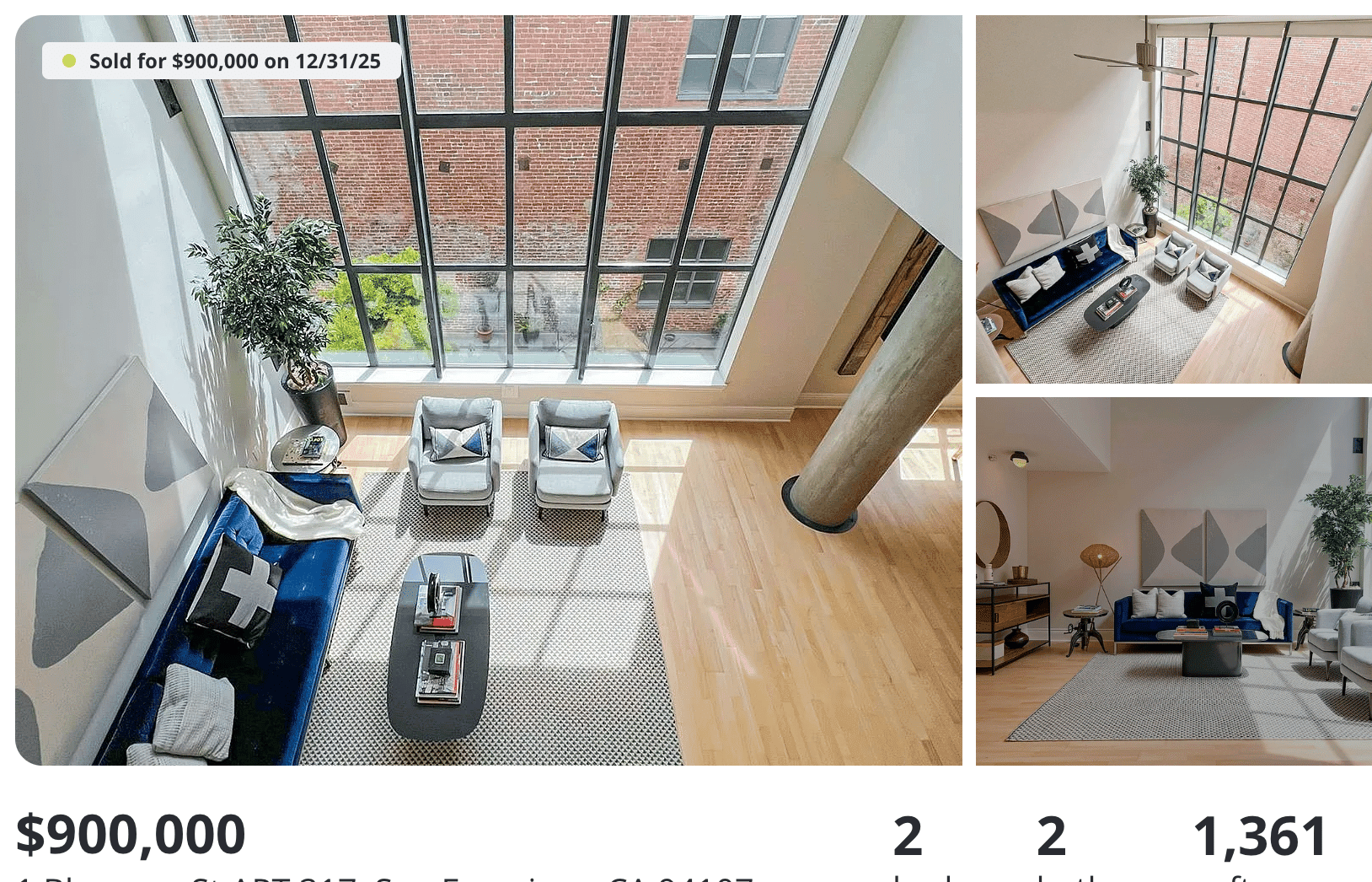

Property (your primary home, land, rental properties)

Valuable personal items (jewelry, collectibles)

Not everything you own functions as an asset in the same way.

For example, your car is an asset—but its value falls as it’s used more and grows older. You have a wardrobe, furniture, and gadgets. They might have sentimental and functional value, even when they don’t make a meaningful difference to your net worth.

When you’re calculating net worth, you don’t have to itemize every little possession. Some recommend doing so in order to confront the reality that you could translate your possessions into money, if needed.

But if you want to save some time when calculating net worth, focus on assets that hold or grow relatively significant monetary value.

What about Debts?

Debt is money you owe. Debts reduce your net worth because they represent claims on your future income. When you have money and debt, it means some of the money you have isn’t really yours to keep.

Common debts include:

Credit card balances

Buy now, pay later

Student loans

Medical debt

Car loans

Mortgages

Money borrowed from friends or family

Personal loans or lines of credit

Here’s where many people get stuck: it’s easy to fall into thinking more about a monthly payment than the total cost of a purchase. If you’re not thinking about your net worth, you may feel tempted to take on expensive debt because you’re looking at a small monthly payment amount.

But with net worth on your mind, you’re looking at the total debt balance rather than just the regular payment amount. A debt isn’t just the minimum monthly loan repayment, an expense in your monthly cash flow; it’s also a burden on your overall net worth.

Putting the Equation to Work

Let’s look at an example.

Imagine you have:

$5,000 in savings

$15,000 in retirement accounts

A car worth $10,000 (no loan)

That’s $30,000 in assets.

Now, suppose you also have:

$20,000 in student loans

$5,000 in credit card debt

That’s $25,000 total debt.

Your net worth = $30,000 – $25,000 = $5,000.

It’s a simple snapshot, but it gives you important clarity. Without net worth on your mind, you might assume you’re doing okay—because the bills are paid on time or your credit score is going up. With it, you see where you stand financially.

How to Improve Your Number

The simplicity of this equation means there are only two ways to increase your net worth:

1. Increase Assets

For example:

Save consistently

Reduce your expenses

Invest for the long term

Grow your income

2. Decrease Debt

For example:

Pay off high-interest debt

Avoid new debt

The financial choices you make often move one or both components of the equation.

Why This Simple Math Matters

This formula is powerful because it cuts through confusion.

You don’t need to be a financial expert to understand it.

You don’t need advanced tools—just awareness of your assets and a pen and paper, or spreadsheet.

You don’t need to overcomplicate things. Sometimes this easy calculation tells you what you really need to know.

When you focus on this simple math, you stop measuring your financial wealth by how much you earn, how much you spend, or how much credit you can access.

Instead, you measure it by what you keep—and that changes everything.

The Bottom Line

Assets minus debts equals net worth.

If you want to grow stronger with money, start here. Tally up what you own, subtract what you owe, and see where you stand. Then you can take small, consistent steps to strengthen your net worth number over time.

It’s simple math—math that those who are strong with money understand.